Global IG: don’t underestimate changed behaviours

- Investment grade markets benefited directly from the fiscal programmes designed to keep the credit channel open, such as furlough schemes, direct lending schemes, banking sector forbearance and expanded purchases of corporate bonds.

- Even for negatively affected sectors, many IG-rated companies have significant levers they can pull in order to react, including cost-cutting, capex phasing, working capital management and inorganic activity such as asset sales, dividend cuts or equity raises.

- While there might be some default or downgrade risks as these schemes wind down, the makeup of the market means it shouldn’t be a major concern, and indeed the outlook for some sectors is as good - if not better - than before the pandemic.

- The combination of policy factors and the fact this asset class can deleverage – and management teams will try to deleverage – makes us quite positive for the future. More positive than we were coming into the year.

We came into 2020 on the back of one of the longest expansion phases ever, with increasingly loose monetary policy extending the growth cycle. Because of that growth and low interest rates, companies had been gearing up and corporate leverage was actually relatively high going into the pandemic.

With Covid-19-related lockdowns, governments and policymakers had to act to prevent an economic shock turning into a financial crisis. To achieve this, programmes were designed to keep the credit channel open. As well as fiscal support packages such as furlough schemes, we saw support through direct lending schemes, banking sector forbearance and expanded purchases of corporate bonds.

Investment grade markets benefited directly from this. In March the US Federal Reserve said it would directly buy corporate bonds for the first time1, which followed the Bank of England and European Central Bank’s expanded corporate quantitative easing (QE).

While there might be some default or downgrade risks as these schemes wind down, the makeup of the market means it shouldn’t be a major concern. IG’s biggest single sector is banks, which is supported by an economic policy to manage losses. So, we would expect credit qualityto go sideways and weaker players to merge with stronger ones. That accounts for almost 25% of the global IG market2. There are also sectors where the outlook is as good, if not better, than before: technology, and food and beverage, which is 10% of the market. Largely unaffected sectors, such as utilities, telecoms and healthcare add up to another 20%. Even real estate, which is 4% of the market but isn’t really a homogenous sector as there are so many different sub-sectors, has seen good performance in some areas. Warehouses and logistics have benefited from home delivery and the Amazon effect. Retail and offices have been more difficult, but that is only 1% or so of the market.

Even for sectors where the pandemic has negatively affected operations and earnings, many IG-rated companies have significant levers they can pull in order to react to that. A combination of cost-cutting, capex phasing, working capital management and inorganic activity such as asset sales, dividend cuts or equity raises can and will be utilised to defend balance sheet credit quality.

We shouldn’t underestimate the fact the pandemic may have changed behaviour significantly. Will we return to five days in the office or is home working here to stay?

However, we shouldn’t underestimate the fact the pandemic may have changed behaviour significantly. Will we return to five days in the office or is home working here to stay? Some sectors may benefit from such changes, like tech or food and beverage, but it might put a question mark over others.

But policy tools are typically applied quicker than they come off. For example, the ECB’s QE lasted longer than was strictly necessary for market stress or the cost of debt for large European corporates. More recently the Fed has said it will move to average inflation targeting3, where even if inflation goes above 2%, interest rates won’t be increased until that level is sustained for some time. So, we expect policy support to last for some time.

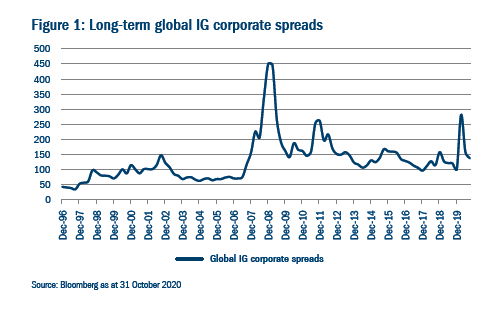

IG spreads globally are at 130bps over government bonds, which is the long-run average (see Figure 1). Yield levels on government bonds and cash rates, meanwhile, are at all-time lows, and equity P/E ratios are at two-decade highs because discount rates were so low. In that context an asset at long-run average valuations is not bad value.

The combination of policy factors and the fact this asset class can deleverage – and management teams will try to deleverage – makes us quite positive for the future. More positive than we were coming into the year.

1. Bloomberg, Fed Will Begin Buying Broad Portfolio of Corporate Bonds, 15 June 2020.

2. All IG market percentages Columbia Threadneedle analysis, November 2020.

3. FT.com, Fed to tolerate higher inflation in policy shift, 27 August 2020

Important Information:

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients).

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This document has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the ce (Chapter 622), No. 1173058.

In EMEA: Issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors’ with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com

Press Contacts:

Gunther De Backer

Olivier Duquaine