Global Perspectives 2021

Seeking out good alpha opportunities in emerging market debt.

- The steady recovery of the asset class since Q2 has been every bit as remarkable as the initial blow-out in spreads back in March. Much of the higher-rated EM universe now trades at spreads over US Treasuries roughly equivalent to those prevailing at the start of the year.

- With valuations in EM sovereigns around long-run averages – and with balance sheet risks now more pronounced –

we are cautious about the potential for significant further spread tightening in hard-currency fixed income. But total return opportunities in the year ahead remain attractive, especially when accompanied by judicious credit selection. - A steady global growth recovery supported by more constructive and multilateral US trade policy may just create ideal conditions for EM currencies to correct some of their underperformance against the US dollar.

- The semi-mature state of EMD markets creates good alpha opportunities across sovereigns and corporates in both hard and local currencies.

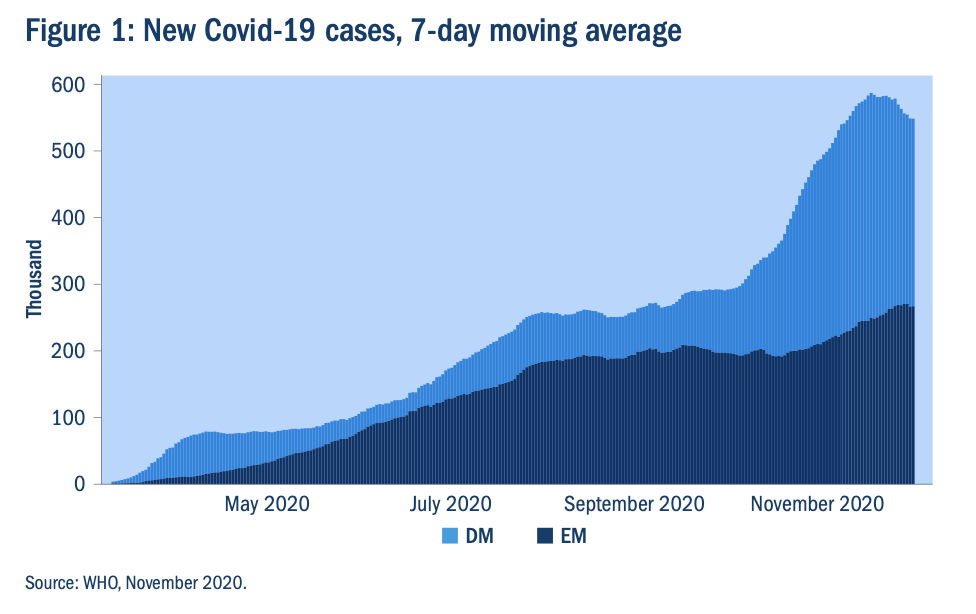

The legacy of Covid-19 in emerging markets (EMs) may take some time to become clear. Having lagged advanced economies’ initial surge in cases in March and April, lower income countries experienced highly concerning case growth at the end of the summer, before once again being eclipsed by the developed markets’ second wave (Figure 1).

There are reasons to expect a slower and less comprehensive vaccine roll-out among EMs than in richer countries, and the fiscal damage done to already-fragile sovereign balance sheets may increase vulnerabilities.

But the steady recovery of the asset class since Q2 has been every bit as remarkable as the initial blow-out in spreads back in March. Much of the higher-rated EM universe now trades at spreads over US Treasuries roughly equivalent to those prevailing at the start of the year.

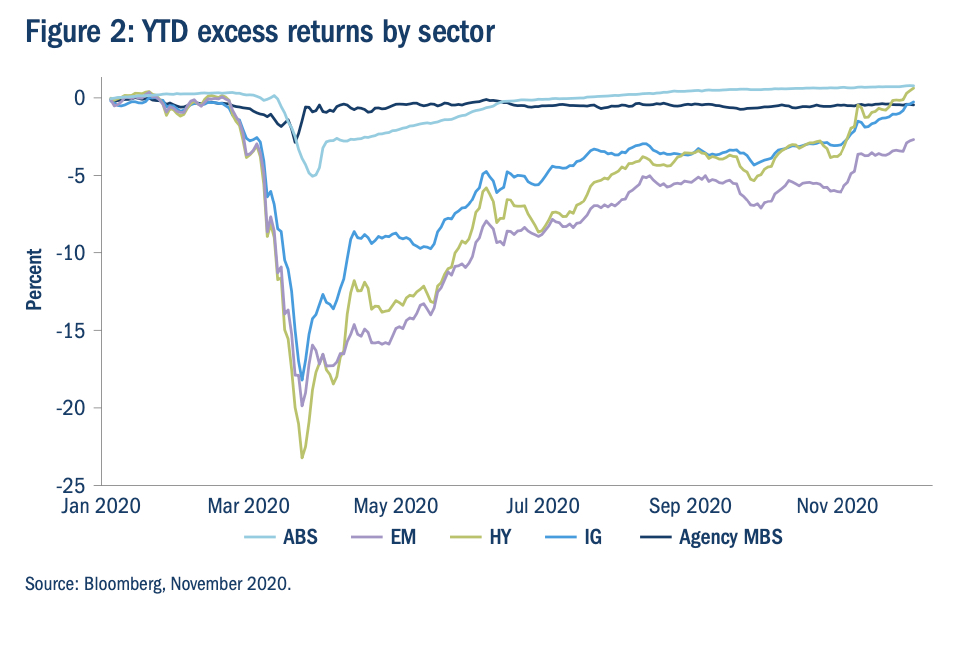

With valuations in EM sovereigns around long-run averages – and with balance sheet risks now more pronounced – we are cautious about the potential for significant further spread tightening in hard-currency fixed income. But total return opportunities in the year ahead remain attractive, especially when accompanied by judicious credit selection. So far this year EMD performance has still to fully catch up with other parts of the fixed income asset class.

The structural tightening of spreads in the early years of the 21st century have given way to a much more cyclical market; the EM credit asset class displays a strong correlation with developed market corporate credit and is well positioned for even a modest global growth recovery in 2021.

Moreover, the global rate environment remains conducive to EMD performance with inflation benign, central banks expected to maintain accommodation and the stock of negative-yielding assets at around $15 trillion.1 Meanwhile, allocations to the asset class among international investors are still low, suggesting persistent inflows in coming years.

Our attention is focused on the higher-yielding end of the EM sovereign and credit markets, where performance has lagged that of both higher- quality EM credits and equivalently rated developed market corporate bonds (Figure 2). The excess yield available in EMD relative to US High Yield does not adequately reflect the lower default rates and higher recovery values observed in the former.

In the EM corporate space, despite a tough year for revenues and increased gross leverage, balance sheets tend to be rich with undeployed cash and deleveraging potential as earnings recover next year. As ever, selectivity and discerning fundamental analysis are essential.

EM local currency bonds also present an interesting opportunity as we move into the next phase of the Covid cycle. The combination of deteriorating fiscal health, as governments rushed to insulate their economies, and aggressive monetary easing enabled by tame inflation, has left many local currency yield curves unusually steep.

It will be unwise to ignore the vulnerabilities implied by those policies over the longer run. But relative to those on offer in advanced economies, real yields are attractive even on a currency-hedged basis.

More importantly for returns, a steady global growth recovery supported by more constructive and multilateral US trade policy may just create ideal conditions for EM currencies to correct some of their underperformance against the US dollar.

As ever, the semi-mature state of EMD markets creates good alpha opportunities across sovereigns and corporates in both hard and local currencies. We continue to focus on pairing rigorous, fundamental analysis with macro research to identify the best risk/reward opportunities.

1 Bloomberg, Negative-Yielding Debt Hits Record $15 Trillion on Trade Woes, 5 August 2019.

Important Information:

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients).

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This document has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the ce (Chapter 622), No. 1173058.

In EMEA: Issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors’ with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com

Press Contacts:

Gunther De Backer

Olivier Duquaine