Global Perspectives 2021

A bizarre year of win-lose outcomes in Asia Pacific ex Japan

- Equity markets quite quickly found a bottom around late March, shortly after China reported no locally spread infections for the first time since the Wuhan outbreak. For investors in Asia, this was an important signal that the disease spread could be suppressed.

- The shift online of both corporate and consumption activities saw hardware and software technology rise to

the occasion, accelerating trends that were already in motion pre crisis. The strength of China’s online ecosystem, which is heavily represented in the China Index, helped support a return to positive economic growth in Q2 as production started to return after the spread of Covid-19 was brought under control. As such, for the full year China is likely to grow 2% in 2020, outperforming developed nations by a wide margin. - The Trump administration’s continued adversarial approach towards China, including exerting pressure on US allies to stop using Huawei 5G equipment, and measures aimed

at restricting supply chains of high-end semiconductor chips and equipment to Chinese companies, forced China to embark on a push towards supply chain self-reliance, particularly in high-tech components. - Joe Biden’s presidency should see the return of professional US diplomacy, with the effort to “heal America” spilling over to the rest of the world, including in US-China relations and China-Australia relations, though some damage may remain.

If I were to sum up Asia ex Japan equity markets in 2020, it would be the pain of negative headwinds followed by the triumph of human ingenuity and determination in rising above them. This perhaps seems too optimistic a story for such a year, given how the world has suffered from Covid-19, but not too far-fetched if the performance of equity markets can be submitted as a verdict.

Pandemic pain

Equity markets quite quickly found a bottom around late March, shortly after China reported no locally spread infections for the first time since the Wuhan outbreak. For investors in Asia this was an important signal that the disease spread could be suppressed. The pandemic’s impact in the US brought forth strong monetary stimulus, which facilitated central banks in Asia to do likewise without fear of severe currency weakening. This sparked fresh optimism.

'The prospect of a post-pandemic recovery should see very strong economic performances across the world, with Asia’s growth again anchored by China'

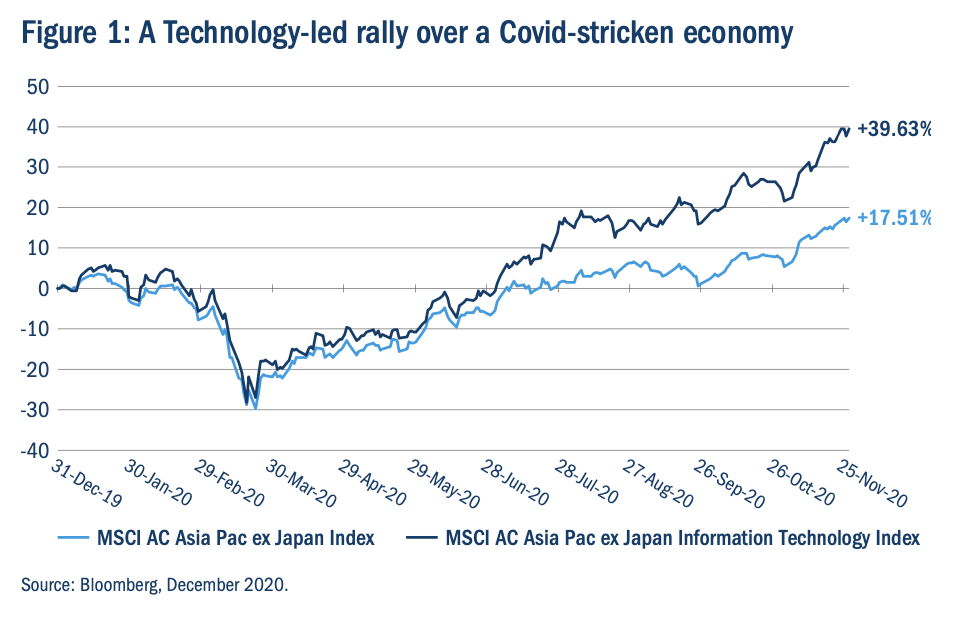

The shift online of both corporate and consumption activities saw hardware and software technology rise to the occasion, accelerating trends that were already in motion pre crisis. As a result, the information technology sub-index grossly outperformed (see Figure 1), resulting in the strong performances of the Taiwan and Korea equity indices.

The strength of China’s online ecosystem, which is heavily represented

in the China Index, helped support a return to positive economic growth in Q2 as production started to return after the spread of Covid-19 was brought under control. As such, for the full year China is likely to grow 2% in 2020, outperforming developed nations by a wide margin.

Not all Asia economies fared as well, however. Those countries more heavily reliant on tourism, such as Thailand, suffered badly. India, Indonesia and the Philippines also had difficulty keeping infections in check, while lacking the benefit of a more buoyant online ecosystem to facilitate continuing commercial activities where people movement had to be curtailed.

Political hostilities

The Trump administration continued its adversarial approach towards China, including exerting pressure on US allies to stop using Huawei 5G equipment, and measures aimed at restricting supply chains of high-end semiconductor chips and equipment to Chinese companies. This forced China to embark on a push towards supply chain self-reliance, particularly in high-tech components.

This forms part of China’s broader “dual circulation” strategy targeted at increasing the reliance on its own demand for sustaining economic growth. Other aspects include the promotion of domestic travel and strengthening the quality of local brands to compete with premium foreign goods. Notably, it does not mean moving away from China integrating itself into the global trading network, with the China-led Regional Comprehensive Economic Partnership (RCEP) successfully signed in November with the 10 South-east Asian countries, South Korea, Japan, Australia and New Zealand. China is also considering joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which replaced the Trans-Pacific Partnership (TPP) following US withdrawal under Trump’s “America first” pivot.

Climate change

China’s climate change efforts also forged ahead during the year, with stocks linked to electric vehicles (EVs) and solar energy capping a stellar year for equities. These stocks should continue to do well in 2021 under President-elect Joe Biden as he seeks to turn the US back towards the climate change agenda in the next four years.

2021: potentially more win-win outcomes

In geopolitical terms, Biden’s presidency should see the return of professional US diplomacy, with the effort to “heal America” spilling over to the rest of the world, including in US-China relations and China-Australia relations, though some damage may remain.

'China’s climate change efforts forged ahead during the year, with stocks linked to electric vehicles and solar energy capping a stellar year for equities'

The prospect of a post-pandemic recovery should see very strong economic performances across the world, with Asia’s growth again anchored by China where the street and the World Bank is expecting around 8% real GDP growth.1 Against this backdrop, 2021 should be another strong year for equities, whereby sectoral performances are less bifurcated. Non-tech sectors should rebound strongly, but tech stocks will also perform as themes such as 5G, artificial intelligence, big data, EVs, cloud computing, ecommerce and video live-streaming still have lots of momentum.

1 World Bank East Asia and Pacific Economic Update, openknowledge.worldbank.org, October 2020.

Important Information:

For use by Professional and/or Qualified Investors only (not to be used with or passed on to retail clients).

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act and relies on Class Order 03/1102 in marketing and providing financial services to Australian wholesale clients as defined in Section 761G of the Corporations Act 2001. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This document has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the ce (Chapter 622), No. 1173058.

In EMEA: Issued by Threadneedle Asset Management Limited. Registered in England and Wales, Registered No. 573204, Cannon Place, 78 Cannon Street, London EC4N 6AG, United Kingdom. Authorised and regulated in the UK by the Financial Conduct Authority. This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors’ with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. columbiathreadneedle.com

Press Contacts:

Gunther De Backer

Olivier Duquaine